Unpacking That40YearGuy Net Worth: A Look At Financial Wisdom From TikTok

Many folks are quite curious about the financial standing of popular online personalities, and it's almost a natural thing to wonder. When someone like Dustin Hadley, better known as That40YearGuy on TikTok, captures millions of eyes with his practical tips and engaging content, questions about his financial picture, so his net worth, often come up. It's a way people connect the dots between online success and real-world prosperity, you know?

This curiosity isn't just about a number, though. It's really about understanding the principles that might lead to such success, especially when someone shares life advice. That40YearGuy has built a very substantial following, offering tips that resonate with a wide audience. People often look to creators like him for more than just entertainment; they seek inspiration, perhaps even guidance, for their own lives and financial paths.

This article will take a closer look at what we can learn about That40YearGuy's financial approach, drawing from the insights he shares and the details about his lifestyle. We'll explore how his content touches on important financial ideas, helping us think about net worth not just as a figure, but as a reflection of choices and habits. It's kind of fascinating, actually, how these things connect.

Table of Contents

- Who is That40YearGuy? A Quick Look at Dustin Hadley

- The Financial Philosophy of That40YearGuy: More Than Just Life Hacks

- The Power of Prudent Choices: A Minimalist Approach

- Understanding Net Worth: Insights from That40YearGuy's Content

- Boosting Your Savings: The 1% Strategy

- Financial Milestones Through the Decades

- Tracking Your Financial Journey: Lessons from That40YearGuy

- People Also Ask About That40YearGuy's Finances

Who is That40YearGuy? A Quick Look at Dustin Hadley

Dustin Hadley, known widely as That40YearGuy, has become a pretty big deal on TikTok, gaining a lot of fans for his unique style. Born on December 10, 1982, this Sagittarius from the United States has truly built a massive following. He's got about 4.3 million followers on TikTok, which is quite a crowd, and his videos have racked up over 98 million likes. That's a lot of engagement, truly.

At 42 years old, Hadley represents a rather distinct group on TikTok. He shows that age isn't really a barrier when it comes to making popular content. His videos often focus on practical life hacks and engaging bits that people find helpful and entertaining. He's known for sharing tips, food ideas, and various tricks, making his content quite varied, you know.

Here’s a quick summary of his public details:

| Detail | Information | ||

|---|---|---|---|

| Full Name | Dustin Hadley | ||

| Online Alias | That40YearGuy | ||

| Birth Date | December 10, 1982 | ||

| Age (as of 2025 reference) | 42 years old | ||

| Zodiac Sign | Sagittarius | ||

| Origin | United States | ||

| TikTok Followers | Around 4.3 million | ||

| TikTok Likes | Over 98.4 million | Content Focus | Practical life hacks, tips, food, tricks |

His presence on TikTok is pretty significant, showing how someone can connect with millions by just being themselves and offering useful advice. It’s a testament to how genuine content can really find its audience, and that's something many creators strive for, you see.

The Financial Philosophy of That40YearGuy: More Than Just Life Hacks

When you look at That40YearGuy's content, which centers on practical life hacks, it's pretty clear that these tips often touch on financial wisdom in an indirect way. Many hacks are about saving time, making things last longer, or finding clever solutions, all of which can lead to better money management. It's not always about big financial moves; sometimes, it’s about the small, everyday choices that add up, you know?

His content, while not strictly about finance, seems to embody a certain financial philosophy. It’s about being resourceful and making smart decisions with what you have. This approach, which focuses on getting the most out of resources and being clever with daily tasks, can actually be a big part of building personal wealth. It’s a very practical way to live, really.

The Power of Prudent Choices: A Minimalist Approach

The text mentions a certain lifestyle that could be described as quite minimalist, and it's something that definitely influences one's net worth. Someone who has no family or dependents to provide for, and who doesn't care much about material possessions or luxury items, is already in a different financial position. This kind of mindset means less spending on things that many people consider necessities, but are truly optional, you know?

Consider the details: having the same used car for two decades, rarely buying new clothes, not dating or going out to spend money, and even avoiding travel. This kind of "boring" or introverted single lifestyle, as it's described, means significantly fewer expenses. Every dollar not spent is a dollar saved or invested, and that really makes a difference over time. It's a very direct path to accumulating wealth, apparently, by simply spending less.

This approach highlights how personal choices about consumption can have a huge impact on financial standing. It’s not always about earning a massive income, but rather about managing what you have and avoiding unnecessary outflows. For someone living like this, their net worth could grow quite steadily, just because they are keeping their costs very low. It's a simple, yet powerful, idea.

This kind of disciplined spending, where you prioritize saving and avoiding debt, can set someone up for long-term financial stability. It's a clear example of how a frugal lifestyle can lead to substantial personal wealth, even without a huge salary. It’s a lesson that resonates with many people trying to improve their own financial situations, too.

Understanding Net Worth: Insights from That40YearGuy's Content

The information provided touches on the broader topic of net worth, especially how it relates to different age groups in America. It brings up the idea of "the real median net worth by age group" and even "suggested net worth targets." This suggests that That40YearGuy's content, or at least the context around it, aims to help people understand where they stand financially and how they might improve their situation. It’s a pretty important conversation, actually.

Comparing your own financial picture to these median figures can be a useful way to gauge progress, though it's good to remember that everyone's situation is unique. The text even mentions that their "suggested net worth targets" are "different from fidelity!", which implies a distinct perspective on financial goals. This kind of advice encourages people to think critically about their own money habits and what targets make sense for them, you see.

Boosting Your Savings: The 1% Strategy

A fascinating idea mentioned is "how you could boost your savings with the 1% strategy." This sounds like a very practical and achievable way to increase savings without feeling overwhelmed. A 1% increase, whether in savings rate or investment contributions, might seem small at first, but it can really add up over time due to the magic of compounding. It’s a simple concept, yet very effective for financial growth, truly.

This strategy suggests that even tiny, consistent adjustments to your financial habits can lead to significant improvements. It’s about making gradual, sustainable changes rather than drastic ones that are hard to stick with. This kind of advice fits perfectly with the "practical tips" theme of That40YearGuy's content, offering actionable steps for everyday people to improve their money situation, you know?

It's a gentle nudge towards financial discipline, showing that you don't need to make huge sacrifices all at once to see progress. Just a little bit more saved or invested each time can really change the game for your future financial well-being. This kind of incremental improvement is often the most successful way to build lasting wealth, so it's a very smart approach.

Financial Milestones Through the Decades

The source also talks about "practical tips for each decade of your financial journey" and "the three" (presumably three key financial principles or goals). This structure suggests a thoughtful approach to personal finance that considers different life stages. Financial goals change as you get older, and having advice tailored to each decade can be incredibly helpful. It’s about meeting people where they are, financially speaking, which is a very considerate way to share guidance, you know?

For someone in their twenties, the focus might be on starting to save and avoiding high-interest debt. In their thirties, it could shift to buying a home or planning for a family. By their forties, like That40YearGuy, the emphasis might be on maximizing retirement savings and perhaps planning for larger life events. These decade-specific tips provide a roadmap, making the often-complex world of personal finance feel a little more manageable, truly.

The idea of "three" key principles is also quite compelling. Often, financial success boils down to a few core ideas, like saving consistently, investing wisely, and managing debt. Boiling down complex topics into simple, memorable points makes them much easier for people to understand and apply. It's a very effective way to teach, actually, by keeping things clear and concise.

Tracking Your Financial Journey: Lessons from That40YearGuy

A really important aspect highlighted is the encouragement to "calculate and track your wealth, and automatically measure growth over time." This is a fundamental step for anyone serious about improving their financial standing. You can't really manage what you don't measure, so knowing your net worth and watching it change is key to staying on course. It’s a bit like keeping score in a game, you know, but for your money.

The text asks, "Ever wondered if you're on track with your net worth?" This question directly addresses a common concern for many people. Providing guidance on how to calculate and track wealth gives individuals the tools they need to answer that question for themselves. It empowers them to take control of their financial future, which is a very good thing, truly.

Furthermore, the emphasis on staying "motivated and reach your financial goals faster" shows an understanding of the psychological side of money management. It's not just about the numbers; it's about the drive to keep going, even when things get tough. Seeing your wealth grow, even slowly, can be a huge motivator. It provides tangible proof that your efforts are paying off, which can be incredibly encouraging, you see.

This focus on tracking and motivation ties back to the practical, actionable nature of That40YearGuy's content. It’s about giving people the straightforward steps and the encouragement they need to make real progress. It’s a very human approach to financial well-being, recognizing that motivation plays a big part in sticking with long-term plans.

To learn more about personal finance principles on our site, and to find out how to track your own progress, you might want to check out this page . For deeper insights into managing your money, you could also explore resources from a reputable financial wisdom hub.

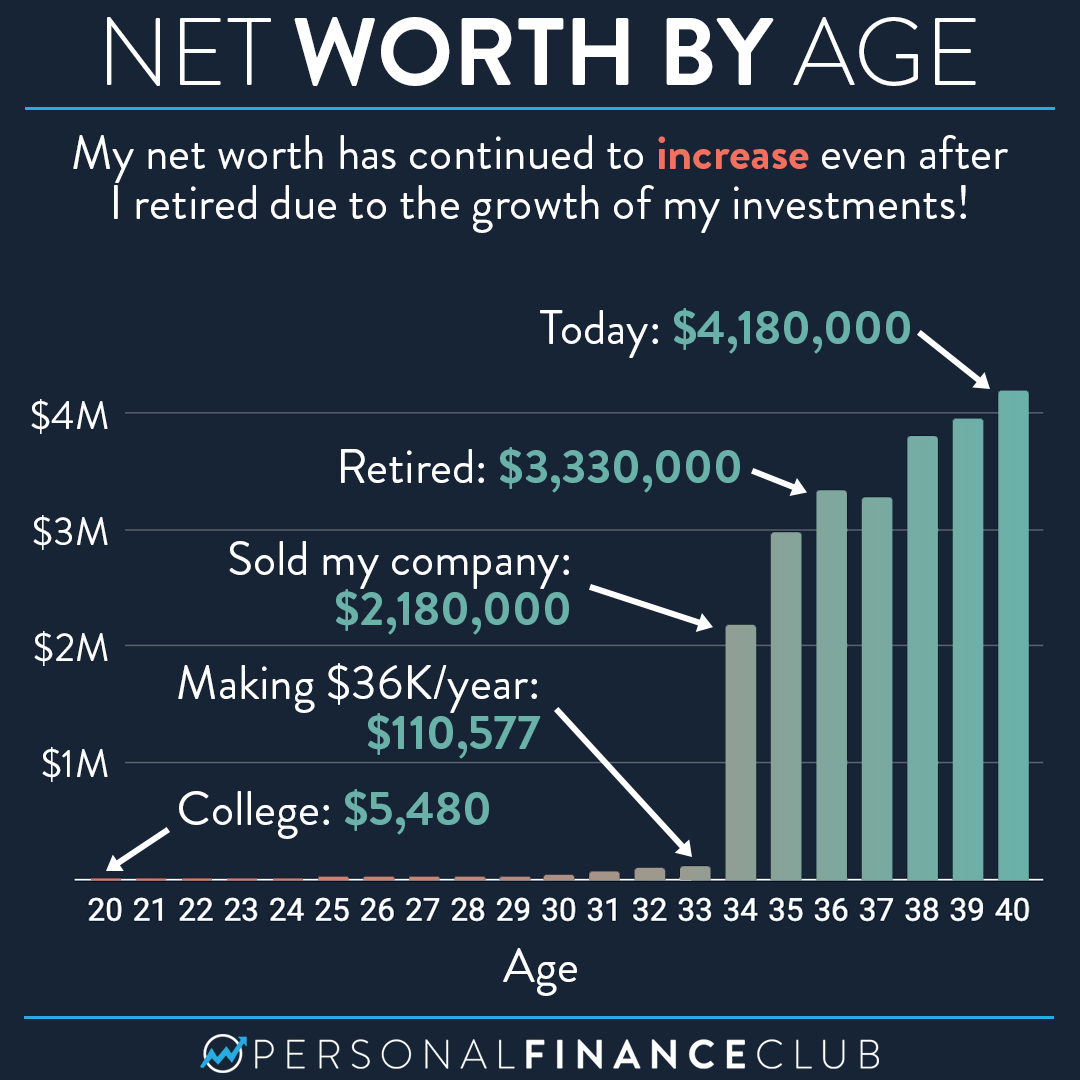

My $4 million net worth breakdown! – Personal Finance Club

NET WORTH OF A LIFE

Here’s how my net worth has changed in the last 20 years – Personal